How to Loop

Opening a position

Opening a position works the following.

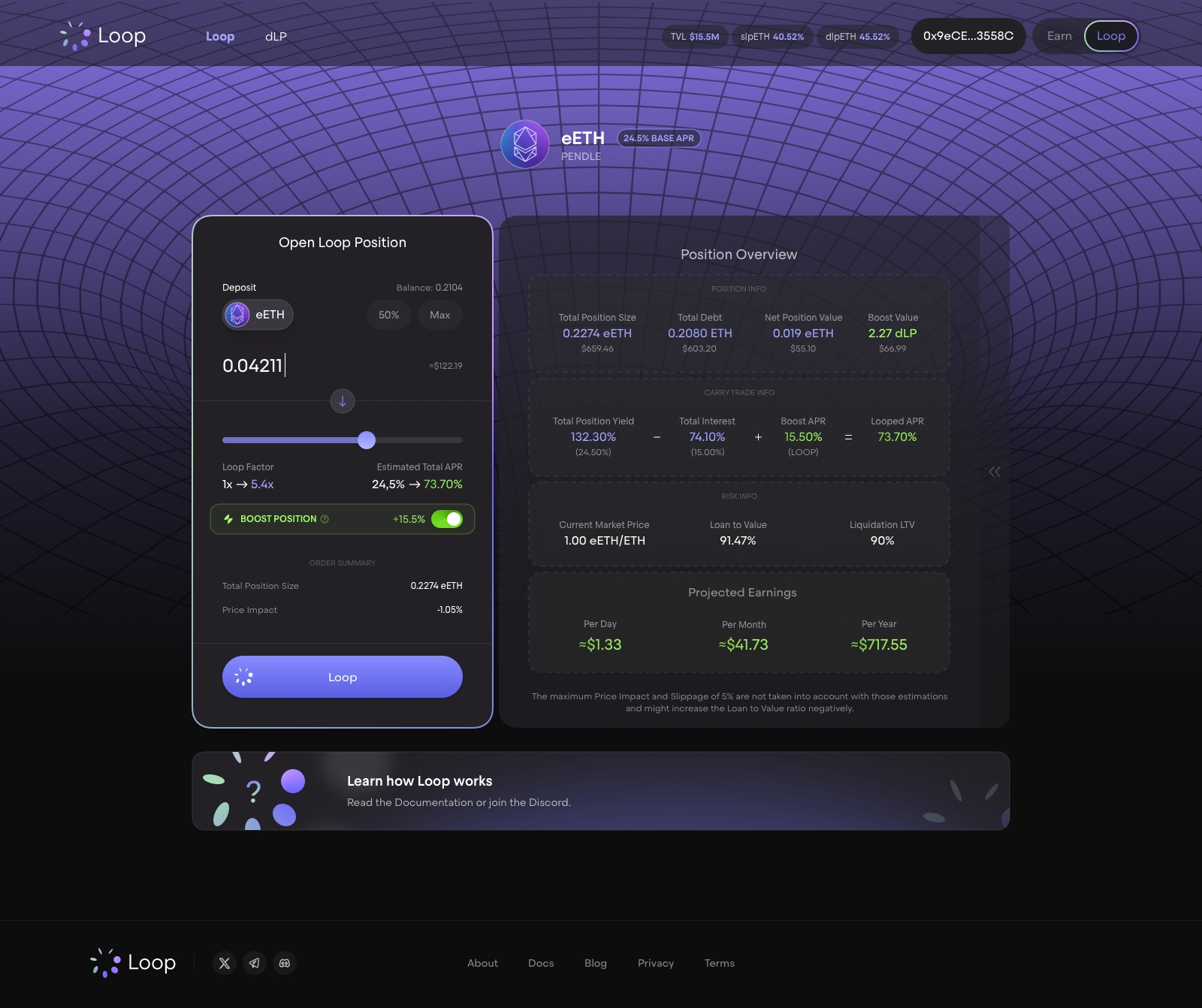

Select the strategy you want to leverage

Chose the asset you want to deposit (does not need to be the underlying collateral of the strategy)

Select the desired Loop factor (which determines how much you want to leverage the underlying collateral)

Enable or disable the Boost (will be live after the TGE)

Check the Liquidation Buffer (You might want a safe protective layer that gives you time to take corrective action)

Check if the price impact and the

Borrow Cost <> Levered Yieldratio is reasonableClick Loop and confirm the Transactions in your wallet.

The ETH borrowed from the lenders and the asset you chose to deposit are then converted to the underlying collateral of the strategy, thus looping your yield and points.

Boosting a Position

Note: This feature will be live after the TGE.

Users can opt-in to boost their position by depositing >5% of their Total Position Size into the dLP. This not only gives them a reinbursement of the interest charged in LOOP tokens but also unlocks the real yield distributed in the dLP. The default Boost Setting are set to lock 6% of the position for 1 month.

Closing a position

Closing a position essentially means paying back the debt you have in ETH to the Reserve Pool. The rest is paid out in either the underlying collateral or in ETH.

Last updated